Cryptocurrency enthusiasts and investors are currently riding the exhilarating waves of a Bitcoin surge. The surge can be attributed to the U.S. Securities and Exchange Commission’s (SEC) nod of approval to 11 spot bitcoin exchange-traded funds (ETFs) in mid-January. The approval has injected a robust optimism into the crypto market, leading to a substantial influx of funds.

The SEC’s Game-Changing Move

In a groundbreaking move, the SEC’s approval of spot bitcoin ETFs marks a significant departure from the previous landscape dominated by bitcoin futures. Unlike their predecessors, spot bitcoin ETFs enable institutional trading of bitcoin at its current market price. This shift has ignited a fresh wave of interest among institutional investors who were hesitant to navigate the complexities of bitcoin futures.

The numbers speak for themselves – a staggering $577 million flowed into spot bitcoin ETFs in a single day. This influx of capital has not only propelled Bitcoin’s value but has also altered the dynamics of the cryptocurrency market.

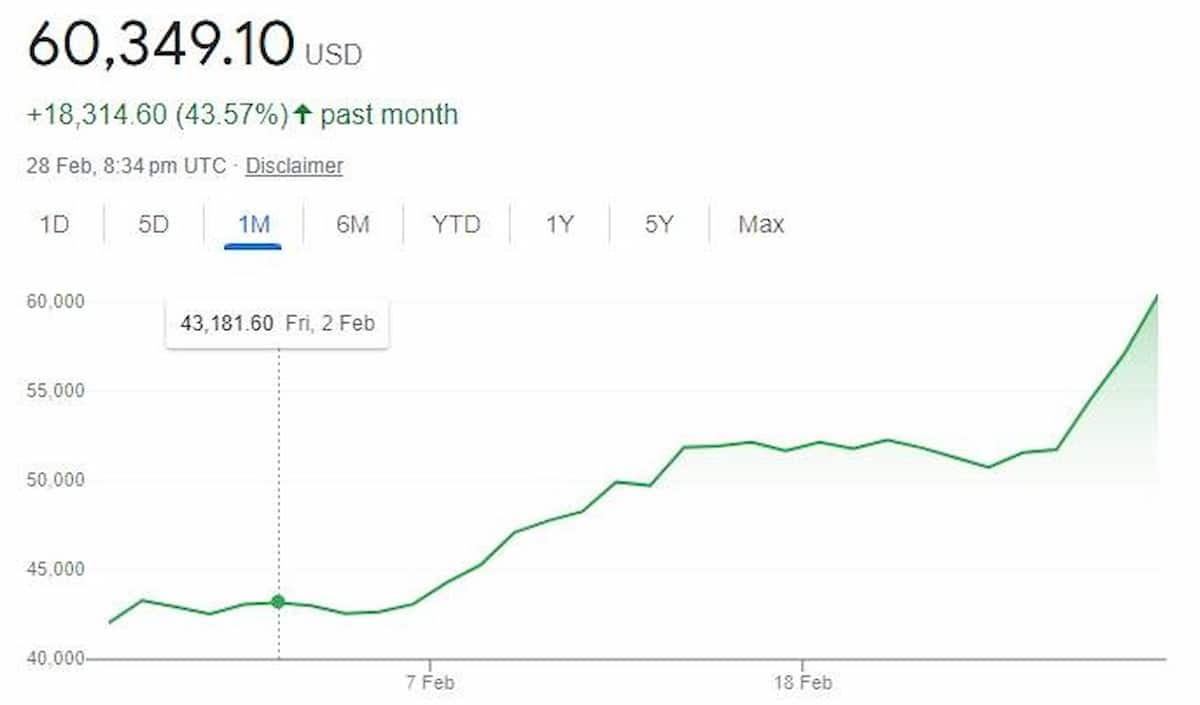

Unpacking the Surge: A 42% YTD Growth

Since the approval of the first U.S. spot bitcoin ETFs, Bitcoin has been on a remarkable tear, showcasing a staggering 42% year-to-date growth. This bullish momentum has propelled Bitcoin’s value from under $50,000 at the time of approval to a soaring figure exceeding $60,000 today.

Let’s break down the key factors driving this surge:

1. Institutional Adoption

The approval of spot bitcoin ETFs opens the door wide for institutional adoption. Institutions, previously wary of the complexities associated with bitcoin futures, are now stepping into the market. This influx of institutional money brings not only capital but also a stamp of legitimacy to the cryptocurrency space.

2. Accessibility and Simplicity

Spot bitcoin ETFs offer a more accessible and simplified way for investors to engage with Bitcoin. Unlike futures, which can be intricate and suitable only for experienced traders, spot ETFs provide a straightforward avenue for both institutional and retail investors to participate in the cryptocurrency market.

3. Positive Market Sentiment

The SEC’s approval has created a positive sentiment ripple throughout the cryptocurrency community. Investors and enthusiasts are buoyed by the regulatory acknowledgment, seeing it as a step toward broader acceptance and integration of cryptocurrencies into traditional financial systems.

Real-Life Impact: Bitcoin’s Journey from $50,000 to $60,000

To put this surge into perspective, let’s take a closer look at Bitcoin’s journey from under $50,000 to over $60,000. This surge represents not just a numerical increase but also a testament to the growing influence of regulatory decisions on the cryptocurrency market.

| Date of SEC Approval | Bitcoin Price |

|---|---|

| Mid-January | <$50,000 |

| Today | >$60,000 |

The table illustrates a swift and substantial rise in Bitcoin’s value following the SEC’s green light for spot bitcoin ETFs.

Riding the Crypto Wave: What’s Next?

As we bask in the current euphoria of Bitcoin’s surge, the question arises – what’s next? Predicting the trajectory of cryptocurrencies is a challenging task, given their inherent volatility. However, we can glean insights by considering a few key factors:

1. Regulatory Developments

Ongoing regulatory developments will play a crucial role in shaping the future of Bitcoin and other cryptocurrencies. Further regulatory clarity and approvals may continue to drive institutional participation and market confidence.

2. Market Corrections

Cryptocurrency markets are known for their rapid fluctuations. Periodic corrections are not uncommon, and investors should be prepared for both upward surges and downward corrections.

3. Technological Advancements

Advancements in blockchain and cryptocurrency technology can introduce new possibilities and use cases, potentially influencing market dynamics.

In conclusion, the recent surge in Bitcoin is intricately tied to the SEC’s groundbreaking approval of spot bitcoin ETFs. This move has not only attracted institutional investors but has also simplified the entry for a broader range of market participants. As we navigate this dynamic landscape, keeping an eye on regulatory developments and market fundamentals will be crucial for anyone looking to ride the crypto wave. So, buckle up and stay tuned for the next twist in this captivating journey!