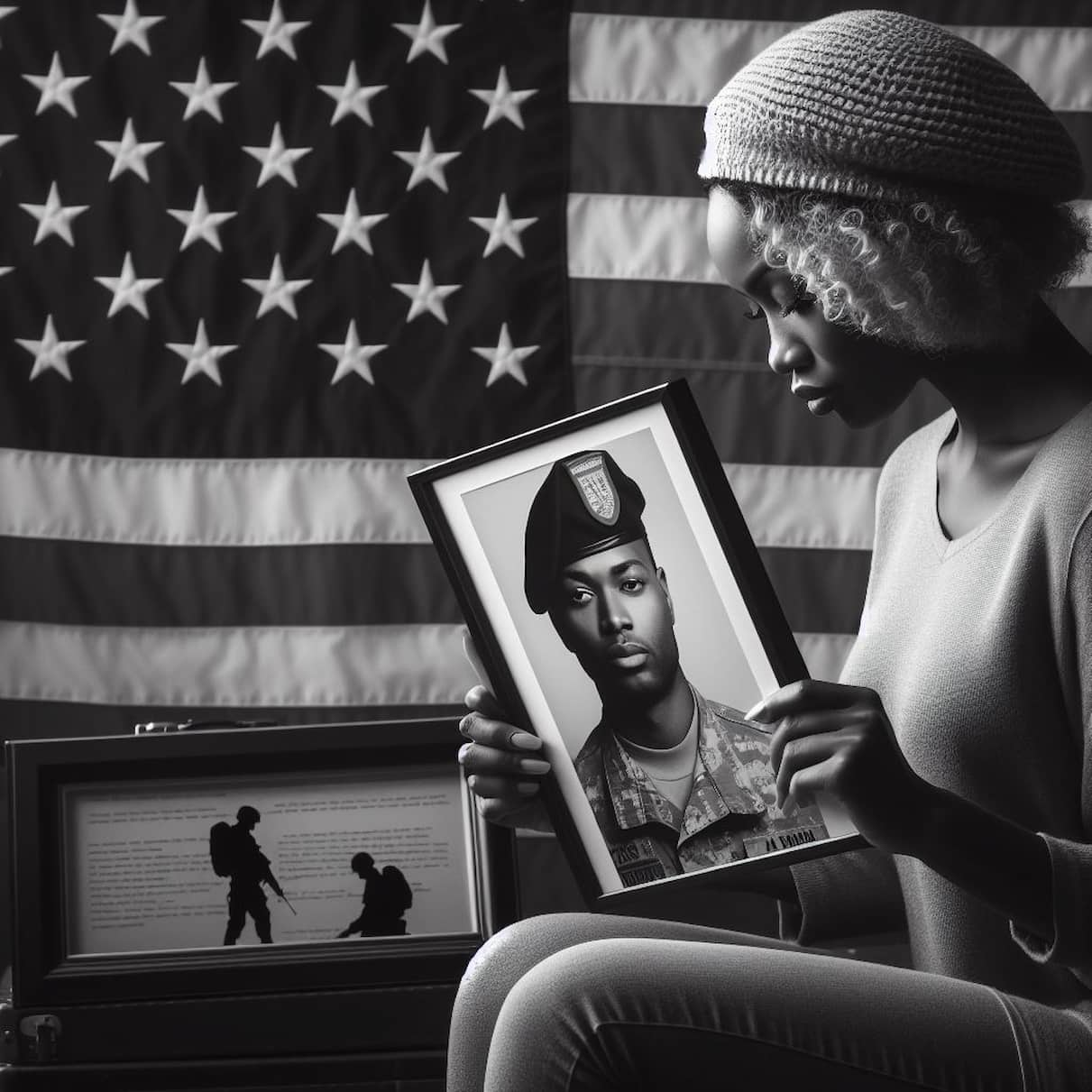

Are you a military spouse with financial questions? Let’s dive into the world of loans, credit, and benefits available to you.

Key Takeaways:

- Military spouses may qualify for loans, but eligibility and terms vary based on factors like credit history and income.

- Bad credit doesn’t automatically disqualify someone from military service, but it can impact loan eligibility and interest rates.

- The Military Lending Act provides protections for service members and their families, including limits on interest rates for certain types of loans.

- Military loans, offered by some financial institutions, often come with competitive interest rates and flexible repayment options.

- Military spouses may receive financial benefits such as housing allowances, healthcare coverage, and education assistance.

- Spouses of service members are considered military dependents, eligible for certain benefits and support services provided by the military.

Exploring Financial Options for Military Spouses:

- Military Spouse Loans:

- Military spouses may qualify for loans from banks, credit unions, or online lenders, but approval depends on factors like credit history, income, and debt-to-income ratio.

- Managing Bad Credit in the Military:

- While bad credit doesn’t prevent someone from joining the military, it can affect loan eligibility and interest rates, making it important to maintain or improve credit health.

- Understanding the Military Lending Act:

- The Military Lending Act offers protections for service members and their families, including limits on interest rates and certain fees for loans like payday loans, auto title loans, and tax refund anticipation loans.

- Insight into Military Loans:

- Some financial institutions offer military loans tailored to the needs of service members and their families, featuring competitive interest rates, flexible repayment terms, and expedited approval processes.

- Financial Benefits for Military Spouses:

- Military spouses may receive various financial benefits, including housing allowances, healthcare coverage through TRICARE, educational assistance like the MyCAA program, and access to base facilities and services.

- Dependent Status and Benefits:

- Spouses of service members are considered military dependents, entitling them to certain benefits and support services provided by the military to ensure their well-being and quality of life.

Addressing Common Financial Queries:

- Can Military Spouses Get Loans?

- Yes, military spouses may qualify for loans, but eligibility depends on factors like credit history, income, and loan purpose. Some financial institutions offer specialized loans for military families with competitive terms.

- Impact of Bad Credit on Military Service:

- While bad credit doesn’t disqualify someone from military service, it can affect loan eligibility and interest rates. Maintaining good credit health is essential for accessing favorable financial opportunities.

- Understanding Military Loans:

- Military loans are financial products designed for service members and their families, offering competitive interest rates, flexible repayment options, and streamlined application processes.

By understanding their financial options and leveraging available resources, military spouses can navigate their financial journey with confidence, ensuring stability and security for themselves and their families.